microsoft Excel

Financial Modeling & Valuation in Excel – Complete Course

- 3,987+ Enrolled

- Last updated Jan 1st, 2025

About the Course

- Boost your productivity by 3X with expert-led training and save 3 hours daily

- Learn 100+ formulas, interactive dashboards, shortcuts, AI features.

- Interactive live practical sessions with 10+ exercises and real-time assistance

- Rated [4.6/5]- Our students have claimed this course as "the best available in the market"

- Learn from industry experts with over 12 years of experience

- This course is suitable for Students, Freshers and Experienced Professionals

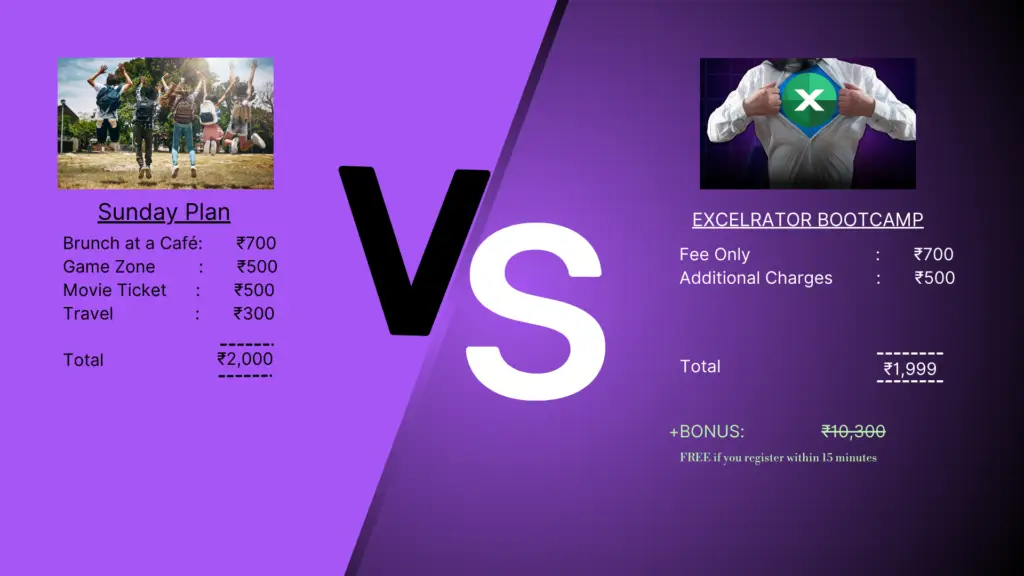

- Get Bonus Contents worth ₹10,300 (We have spent hours to prepare and curate this)

- Get recognised certificate of completion and enhance your LinkedIn profile

Our Learners Excel, Just Like the Brands They Work For!

Here's What You're Going to Learn

- Build financial models from scratch.

- Create dynamic dashboards for insights.

- Analyze financial statements effectively.

- Advanced Excel tools for decision-making.

Grad Me Up's Promises

- Promise 1: You’ll receive structured guidance to build financial models, even if you're a beginner or from a non-finance background.

- Promise 2: You’ll get the opportunity to learn through hands-on training. To address all your doubts during the sessions.

- Promise 3: You’ll acquire practical, no-nonsense methods to value companies and create professional-grade models in Excel.

This Course is Suitable for You if

Students

You are a student looking to build a career in finance and want to learn professional financial modeling and valuation techniques from scratch.

Fresher

You are a fresher in finance/consulting roles and need to master financial modeling skills to excel in your new job and stand out among peers.

Working Professionals

You have 2–9 years of experience but want to upgrade your financial modeling skills to advance your career or transition into investment banking/equity research roles.

What Makes Grad Me Up Different?

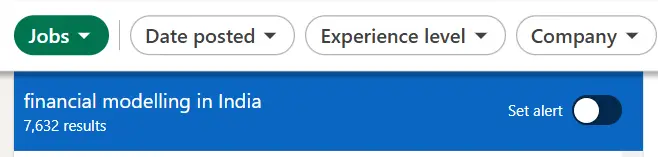

This is a screenshot of LinkedIn. In India alone, there are over 7,500 jobs that demand Financial Modeling

BUT THERE‘S A HUGE PROBLEM

NO ONE IS PROVIDINIG HANDS-ON TRAINING

ALMOST ALL THE TUTORS ARE PROVIDING ONLY PRE-RECORDED LECTURES BECAUSE OF WHICH…

Less than 5% of people complete online courses

No mechanism for feedback and accountability

Data Visualization cannot be learnt by watching videos

We identified this gap and with this Course and we’re on a mission to equip Students and Professionals with practical knowledge that will help them build a fulfilling and rewarding career

Bonus Contents - Worth ₹10,300+

- Bonus 1: Three Financial Model Templates (DCF, Comparable Valuation, and Budgeting) designed by experts to simplify your analysis. [Worth ₹9,200]

- Bonus 2: A comprehensive eBook with 90+ Advanced Excel Formulas and their practical applications in financial modeling. [Worth ₹1,100]

- Bonus 3: A professional Course Completion Certificate by Grad Me Up to boost your career. [Priceless]

- Bonus 4: Exclusive access to a Private WhatsApp Community for networking and expert guidance. [Priceless]

Pricing

Instructors

Co-Founder and Content Creator

Co-Founder

This course includes:

- 10 hours+ Live Lecture

- Access to Recorded Lectures for 6 months

- Hands-on Training with Personal Guidance

- Free Bonus Contents worth ₹10,000+

- Recognised Certificate of Completion

Course Details

Level:

Beginner to Intermediate

(This course is tailored for students, freshers, and working professionals looking to master financial modeling and valuation techniques, regardless of prior experience.)

Access

Life Time

(Get lifetime access to course recordings, materials, and templates to revisit concepts whenever needed.)

Certificate

Shareable

(Earn a recognized certificate of completion to showcase your expertise in financial modeling and valuation on LinkedIn or your resume.)

Learning Format

Live sessions

(Participate in real-time, hands-on exercises with expert guidance. Learn through practical case studies and industry-relevant projects.)

Assignments

Yes, hands-on practice included

(Work on real-world assignments and case studies to build financial models and valuation reports from scratch.)

Module Breakdown

- Mastering Excel shortcuts and navigation.

- Understanding key formulas and functions.

- Data cleaning and preparation techniques.

- Creating dynamic tables and charts.

- Introduction to pivot tables for analysis.

- Understanding the Income Statement, Balance Sheet, and Cash Flow Statement.

- Linking financial statements for consistency.

- Analyzing key financial ratios and metrics.

- Identifying trends through historical data analysis.

- Preparing financial statements for modeling purposes.

- Structuring a financial model: Best practices and layout design.

- Revenue forecasting techniques and assumptions building.

- Expense projections and cost modeling.

- Working capital and depreciation schedules setup.

- Creating integrated financial models (P&L, Balance Sheet, Cash Flow).

- Discounted Cash Flow (DCF) valuation method explained step-by-step.

- Comparable company analysis (trading multiples).

- Precedent transaction analysis overview.

- Enterprise Value vs Equity Value concepts clarified.

- Sensitivity analysis for valuation scenarios.

- Using data validation and conditional formatting effectively.

- Scenario analysis with data tables and goal seek tools.

- Introduction to VBA macros for automation in models (basic level).

- Error-checking and auditing tools in Excel models.

- Creating dashboards to summarize financial insights visually.

- Building a startup valuation model from scratch (case study).

- Financial modeling for mergers and acquisitions (M&A).

- Budgeting and forecasting for a retail business example.

- Analyzing a company’s IPO valuation case study.

- Debt scheduling and leverage analysis examples.

- Hands-on project: Build a complete financial model independently.

- Peer reviews and feedback on project submissions.

- Finalizing the model with expert guidance.

- Preparing a professional presentation of your valuation findings.

- Certificate of completion awarded upon successful submission.

BONUS 1

Three Financial Model Templates Get professionally designed templates for Discounted Cash Flow (DCF), Comparable Company Analysis, and Budgeting. These tools will simplify your financial modeling process. [Worth ₹9,200] FREE

BONUS 2

Excel eBook with 90+ Advanced Formulas

Access a comprehensive eBook featuring 90+ Excel formulas with practical examples tailored for financial modeling and valuation.

[Worth ₹1,100] FREE

BONUS 3

Course Completion Certificate

Earn a prestigious certificate of completion from Grad Me Up. Showcase your expertise in financial modeling and valuation on LinkedIn or your resume.

[Priceless] FREE

BONUS 4

Exclusive Private WhatsApp Community

Join a private WhatsApp group for networking, expert guidance, and continuous learning with like-minded professionals and mentors.

[Priceless] FREE